HUD HOMES REVEALED

Amazing $100 Down HUD Homes!

“We can help turn your dream of home ownership into reality”

About Us

Our company has been helping renters in the south Florida area become proud and happy homeowners for the past 21 years. We have a mission that everyone in our company lives by and believes in. We work harder than anyone to make sure that your home-buying experience is a pleasure one. The way we accomplish this is providing you with the best and most useful advice and instructions available for a smooth and effortless transition from wanting the “American Dream” to actually obtaining it. We’ve been specializing in HUD homes since 1998 and have extensive knowledge regarding their programs and how they can help you.

Services

HUD Financing

If you’ve been thinking about buying a home and have not been pre-qualified by a bank or mortgage broker and would like to know how close you are to qualifying. Contact us today and we’ll put you in contact with our mortgage broker, who specializes in HUD homes. They would be more than happy to help you, with the entire qualifying process.

Since HUD is only requiring $100 down on FHA qualified homes and in many cases, will agree to pay the buyer’s closing close up to 3% buying could not be easier. You simply cannot afford to miss this opportunity. The HUD $100 program has been in existence for many years, but nothing last forever.

Again, we will walk you through the entire process from start to finish. From obtaining the right financing, to taking advantage of the right HUD programs and of course through the process of finding that perfect home for you and your family.

“The process is a simple one. Let us show you how simple and easy it can be”.

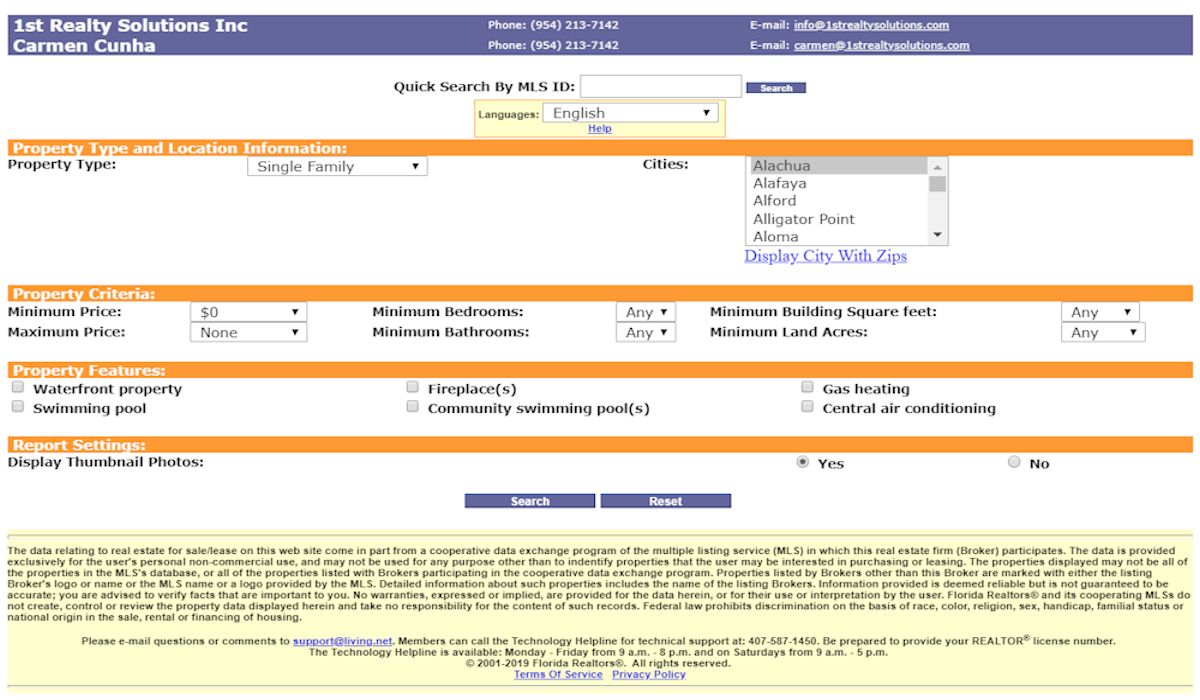

Home Search

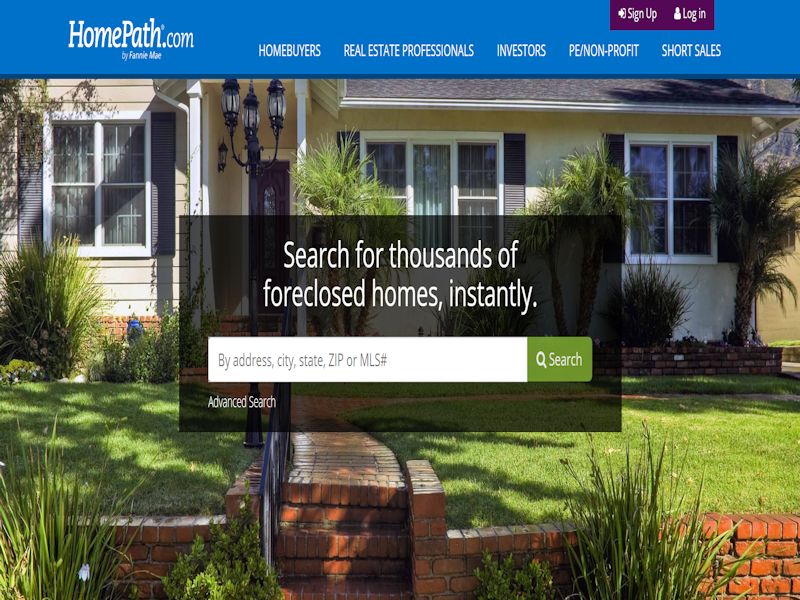

HUD Home Store is the listing site for HUD real estate owned (REO) single-family properties. This site provides the public, brokers, potential owner-occupants, state and local governments and nonprofit organizations a centralized location to search the inventory of HUD (Housinng and Urban Development) properties for sale.

In addition, registered real estate brokers and other organizations can place bids on behalf of their clients to purchase a HUD property. HUD Home Store also includes many informative user-friendly features providing advice and guidance for consumers on the home buying process.

Making the decision to buy may seem more like a giant leap than a first step, but it doesn’t have to. The key is to do your homework and be prepared—whether you’re buying a home next year or next month. Determine what you can afford, consider the location and what you need in the home.

If necessary, work with a lender or mortgage financing professional to determine your options including how much you will need for a down payment. A pre-qualification letter always expedites the contract process when you’re ready to make an offer.

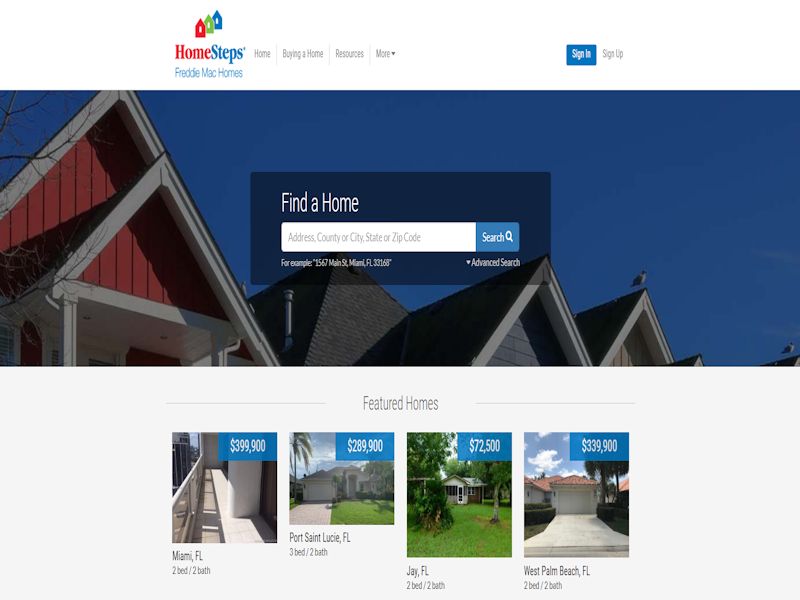

We help thousands of buyers just like you find a home you can call your own. At HomeSteps®, we help you find much more than a house, town home, condominium or duplex. We want you to feel confident about your decision to buy from us, and have the peace of mind you expect and deserve from your new home.

We currently have homes for sale in many areas throughout the country. Search our available homes or visit Freddie Mac’s website to learn more about buying a home or how much home you qualify for.